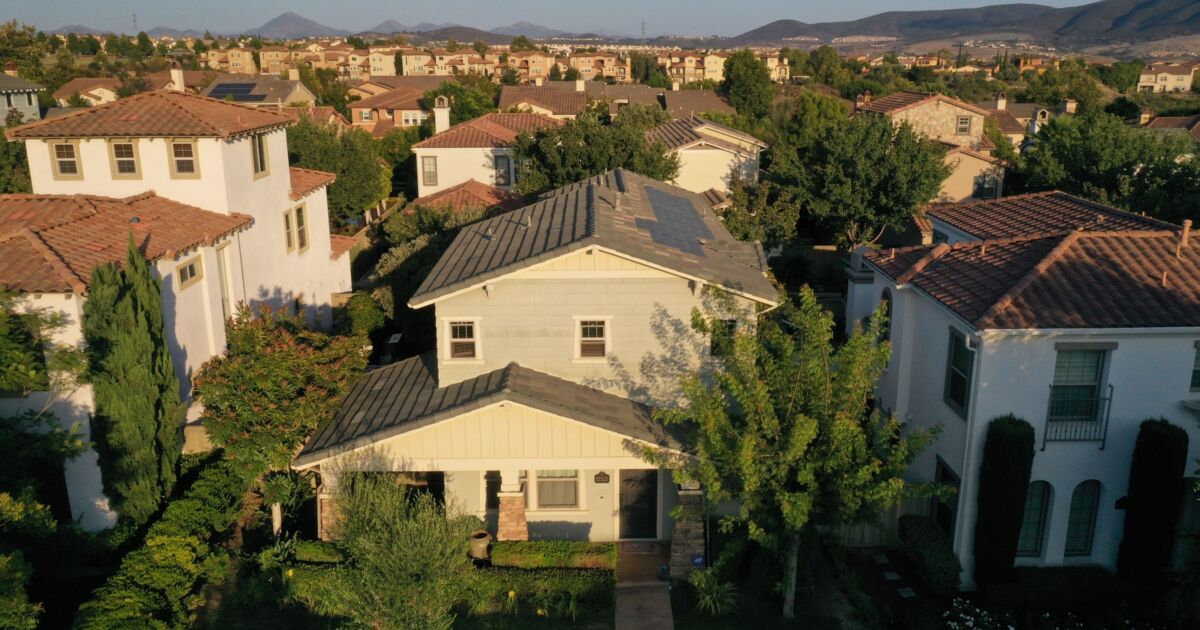

Whereas the surge in residence costs has slowed considerably from the heights of final yr, residence consumers’ affordability issues aren’t abating.

Single-family residence values elevated 8.2% on an annual foundation in November, in line with the newest value index from the Federal Housing Finance Company. Though the tempo of rising costs was nonetheless operating above the compound annual progress charge of seven.5% reported by the FHFA since January 2012, it slowed from October’s 9.8% leap and got here in significantly decrease than the 17.8% surge in November final yr.

On a month-over-month foundation, although, housing prices have remained flat, and in November, they slipped downward nationwide by 0.1% in comparison with October.

“U.S. home costs have been largely unchanged within the final 4 months and remained close to the height ranges reached over the summer time of 2022,” mentioned Nataliya Polkovnichenko, supervisory economist in FHFA’s division of analysis and statistics, in a press launch.

Costs elevated in all areas in comparison with a yr in the past. The will increase ranged from 2.4% within the U.S. Census Bureau’s Pacific division to 12% within the South Atlantic area, with the previous consisting of three West Coast states, Hawaii and Alaska, and the latter stretching from Maryland to Florida.

However between October and November, the Pacific division noticed the biggest falloff in value (1.1%), with the Mountain area coming in 0.8% decrease. In distinction, costs grew on a month-to-month foundation in another areas. They rose by 0.5% within the West North Central division and 0.3% within the West South Central, East North Central and Center Atlantic areas.

The newest FHFA numbers mirror comparable tendencies reported this week within the S&P CoreLogic Case-Shiller value index, though the year-over-year achieve in November got here in barely decrease, whereas month-to-month decreases have been steeper. The Case-Shiller report discovered housing costs that month down by 2.5% from an early summer time peak.

Whereas extensive settlement exists that residence costs softened within the latter half of the yr, perceptions relating to affordability have not elevated correspondingly. A lot of present purchaser sentiment may be laid on larger mortgage charges, which had the impact of pushing funds larger and dampening home-owner curiosity in promoting.

“Whereas larger mortgage charges have suppressed demand, low inventories of properties on the market have helped keep comparatively flat home costs,” Polkovnichenko mentioned.

The sluggishness and lack of availability has been observed by consumers, based mostly on latest survey analysis from the Nationwide Affiliation of Realtors.

Between third and fourth quarters final yr, expectations that the house search would turn into simpler fell from 37% to 24%. On the similar time, a file excessive 87% of respondents in NAR’s survey reported they may afford lower than half the properties of their markets, rising from 69% three months earlier, though mortgage charges persistently headed downward in November and December. NAR’s analysis was carried out in mid December, weeks after rates of interest had hit fourth-quarter peaks.

In one other housing report, researchers from First American discovered affordability, or residence shopping for energy, plummeted 60% yr over yr in November. The title and shutting providers supplier’s Actual Home Worth Index components in mortgage charges and family revenue modifications to find out client shopping for energy within the residential real-estate market. Though revenue elevated from November 2021, “it was not sufficient to offset the affordability loss from larger mortgage charges and still-strong nominal home value progress,” in line with First American Chief Economist Mark Fleming.

Just like FHFA’s findings, no states reported a lower in annual “actual” residence costs.

However “actual property dynamics are native,” Fleming mentioned, noting that cities the place prices leaped significantly within the pandemic years of 2020 and 2021, corresponding to San Francisco and Phoenix, are actually among the many markets seeing costs fall quickly. First American deemed such cities “overvalued,” with median existing-home sale costs exceeding house-buying energy.

“There are exceptions to this relationship, however usually plainly probably the most overvalued markets are correcting the quickest,” he mentioned.

/a-7-5bfc2b3c4cedfd0026c10a26.jpg)