A survey of fogeys finds that they’re more and more involved concerning the impression of inflation and inventory market volatility on their school financial savings.

Constancy’s 2022 Faculty Financial savings Indicator Examine stories that four-fifths of fogeys (81%) are apprehensive concerning the inventory market, up from three-quarters (74%) two years in the past.

On the identical time, concern concerning the Covid-19 pandemic has decreased from 71% to 62%.

Faculty stays the highest financial savings precedence of fogeys of college-bound youngsters and they’re rising the quantity they save as school prices proceed to extend. Three-quarters (76%) of fogeys have began saving for school, up from 58% in 2007.

However, whereas mother and father hope to save lots of two-thirds of their little one’s school prices (69%, up from 65% in 2020), they’re falling wanting this objective. Dad and mom are on observe to save lots of 27% of faculty prices, down from 33%. This can be as a result of a majority of fogeys are counting on guesses about school prices as a substitute of precise information.

Virtually a 3rd (30%) of fogeys with pupil loans haven’t but began saving for his or her youngsters’s school training. 88% of fogeys with pupil mortgage debt plan on redirecting their pupil mortgage funds to school financial savings when they’re carried out repaying their pupil loans.

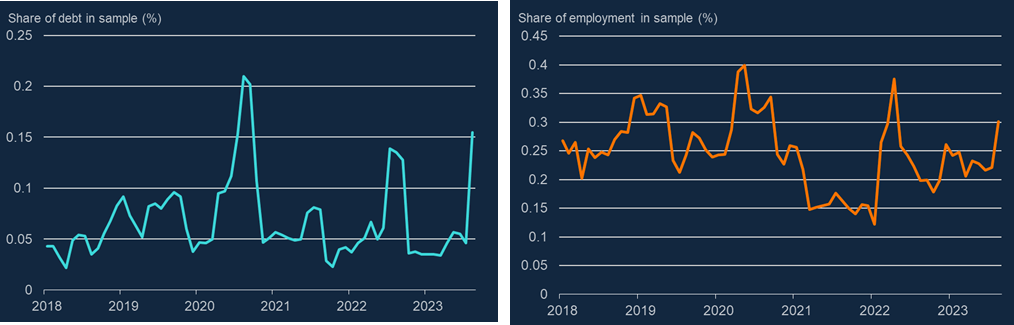

Impression Of Inflation On The Inventory Market

Inflation charges seem to have peaked at 9.1% in June 2022. However, inflation charges are nonetheless elevated at 8.3% in August 2022. Inflation charges haven’t been this excessive since 1982.

The Federal Reserve Board has been rising rates of interest by a complete of two.25% since March 2022 to attempt to management inflation.

Inflation is brought on by a mismatch of provide and demand. Not too long ago, it has been triggered by provide chain issues, the conflict in Ukraine and the pandemic.

Growing rates of interest will increase borrowing prices, affecting bank cards, auto loans, enterprise loans and mortgages. The Federal Reserve hopes that this can sluggish spending.

However, rising rates of interest is a blunt instrument that’s not narrowly focused on the root causes of inflation. The current will increase in inflation are a worldwide phenomenon. Additionally, historic information present at greatest a weak correlation between rates of interest and inflation charges.

But, rising rates of interest is the first software obtainable to the Federal Reserve. When your solely software is a hammer, all the pieces appears like a nail. Or, extra aptly, when your solely software is a screwdriver, traders get screwed.

Inventory valuations rely partially on calculating the online current worth of future income streams. A better low cost fee, akin to increased rates of interest, yields a decrease valuation.

So, inventory market turmoil is more likely to proceed for so long as the Federal Reserve continues to tinker with rates of interest, in all probability for the subsequent yr or so. However, rate of interest strikes by the Federal Reserve, and the inventory market’s response, are inherently exhausting to foretell.

Sensible Ideas For Faculty Savers

Traders ought to subsequently keep the course and stay invested, persevering with to speculate each month. In response to the Constancy examine, 83% of fogeys are planning to extend or keep the quantity they contribute to school financial savings plans this yr. Pulling your funding now will solely lock in losses, inflicting you to overlook out on the financial restoration. Liquidating a 529 plan could result in a tax legal responsibility.

Inventory market volatility has much less of an impression on households who selected an age-based or enrollment-date asset allocation. Such dynamic funding glide paths alter the combo of investments periodically, decreasing the proportion invested in shares as school approaches. Greater than two-thirds of 529 plans are invested in age-based on enrollment-date funding choices.

These funding choices backside out at about 10% to twenty% in shares when school enrollment is imminent or when the coed is already enrolled in school. This reduces the impression of a bear market or correction on school financial savings. Throughout any 17-year interval, there’s no less than one bear market and no less than three corrections.

Traders can use pupil loans to delay taking a distribution from their 529 plans. Certified distributions from 529 plans can be utilized to repay as much as $10,000 every in pupil loans for the beneficiary and the beneficiary’s siblings. This can be a lifetime restrict per borrower. Father or mother loans may also be repaid by quickly altering the beneficiary from the coed to the mother or father.

/a-7-5bfc2b3c4cedfd0026c10a26.jpg)